Let’s not sugar coat it — we’re all a bit voyeuristic when it comes to other people’s money. How much do averag think they make? How much do you think they have? How did they afford that car? Can you believe that so and so is buying a house? And let’s talk about millennials — which is likely you, and is me. Well, the media seems to portray millennials as broke, unable to pay their student loans, and never able to buy a house. Millennials are supposedly delaying marriage and all sorts of stuff because they are poor and burdened by debt. I don’t think that’s the case. With anything financially related, there is never an easy answer. But I think there are just as many millennials crushing it financially. Maybe there’s a bigger picture here we need to consider. Maybe we just need to ignore the mainstream media when it comes to wealth. Let’s break it down makong then look at the average net worth for millennials.

Trending News

But that rises and falls depending on how close you are to peak earning age , which is typically around age 49 for men and 40 for women. How does your salary compare? Below, check out the median earnings for Americans in every age group, according to data from the Bureau of Labor Statistics for the second quarter of The numbers prove drastically different when broken down by gender. Here’s how much men earn in every age group:. This year, America celebrated Equal Pay Day on April 10, which marks the time a woman would have to work into the new year to symbolically achieve the same pay a man earned the previous year. For Native American and Latina women, it wouldn’t be until Sept. Male college graduates earn more from the get-go. From ages 22 to 32, pay for female college graduates actually grows slightly faster than it does for men. However, a shift occurs at age 33, when women’s earnings growth starts to slow and men’s remains steady. This is an updated version of a previously published article. Like this story? Get Make It newsletters delivered to your inbox. All Rights Reserved. Skip Navigation. VIDEO Make It. Trending Now. Here’s the net worth of the average American family. Follow Us. Terms of Service Contact.

The Above Average Person is loosely defined as:

Are you making enough money? But some people just want to know how their pay compares to that of other people their age. To help you get a sense of where you stand, we took a closer look at the average salary by age for full-time workers in the U. These numbers are for full-time workers in each age set. As you might imagine, the lowest salary by age group is the one comprised entirely of teenagers, many of whom are only working summer jobs. As a general rule, earnings tend to rise in your 20s and 30s as you get promoted and receive raises.

What’s Included in Net Worth?

On this page is an individual income percentile by age calculator in the United States for Enter an age and pre-tax income earned in full-year to compare to the income distribution by age. Also, you can plot income distribution for other ages using the pull-down menu. Need a different tool? Yes, the data is a bit noisy. There is some explanation in the average income by age research post , but in short when you divide by age you are reducing the number of samples. And yes, of course, this interacts with cost of living and household construction see our household income research. Please excuse that infographic-sized chart. I wanted to make sure you could see all ages from You can cross this with our estimated worker count by age to get an estimated absolute number. As before, mind the trend not the exact number. Like other research, this chart suggests default income growth — even for relatively high earners — until someone is in their low to mids. More on that in the next few sections. Last year we dedicated a chart showing the 25th, 50th, and 75th percentile of earnings over a career. My research shows that 66 is the median retirement age in the United States. That in mind, you can get a decent feel for the middle half of the income graph with this income visualization:. Once again, we see the common pattern — income at a percentile tends to rise from younger workers, and reaches a plateau around ages In a perfectly meritocratic country, ability to do the job, supply, demand, and experience would be the inputs to a fair salary model.

THE IMPORTANCE OF REAL ESTATE

As a simple baseline calculation, let’s say you take 2 weeks off each year as unpaid vacation time. Then you would be working 50 weeks of the year, and if you work a typical 40 hours a week, you have a total of 2, hours of work each year. In this case, you can quickly compute the annual salary by multiplying the hourly wage by Want to reverse the calculation? Now let’s consider the case where you get paid 31 dollars an hour, but you get an additional 2 weeks of paid vacation.

You get the same result if you work all year with no vacation time. In the previous case, we assumed 2 weeks of unpaid vacation, so your total year consisted of 50 weeks. But if you get paid for 2 extra weeks of vacation at your regular hourly rateor you actually work for those 2 extra weeks, then your total year now consists of 52 weeks.

Assuming 40 hours a week, that equals 2, hours in a year. If you wanted to be even more accurate, you can count the exact number of how much money is average 31 year making days this year. It has a total of days in the year including both weekdays and weekends.

There are weekend days counting every Saturday and Sunday in the yearand weekdays Monday through Friday. So if you worked a normal 8 hour day on every weekday, and didn’t work any overtime on the weekends, you would have worked a total of 2, hours over the year.

Remember that most companies give employees time off for various holidays, so that should really be included in the calculation. So your yearly income wouldn’t necessarily change, but the actual number of hours you work over the year might be slightly.

If you’re working a regular 8-hour day, then you can simply take your hourly wage and multiply it by 8 to get your daily rate. Of course, some months are longer than others, so this is just a rough average.

Another way to estimate the amount you make each month is to divide the annual salary by 12 months. You can factor in paid vacation time and holidays to figure out the total number of working days in a year. The salary calculator will also give you information on your daily, weekly, and monthly earnings.

Remember that a full salary with benefits can include health insurance and retirement benefits that add more value to your total annual salary compared to similar hourly rates. You may also want to factor in overtime pay and the effects of any income taxes on your take home pay. Type in your own numbers to convert hourly to annual pay.

Wealth Inequality in America

Savings account?

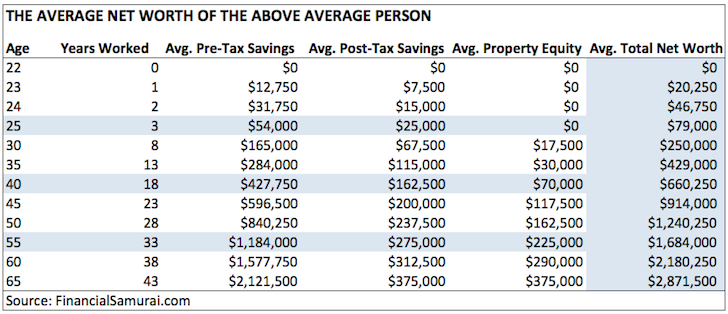

Get out your calculator and see just how you stack up against your peers. Ls is your net worth? Knowing your personal net worth is one of the most important aspects of personal finance. Figuring out your net worth is easy. Add up the total value of all of your assets. Add up the total value of all of your debts. Now subtract the assets from the debts. You might have a positive net worth or a negative one. We know someone who will do the math aveerage you for free. They also do a ton of other things for free like track your spending, analyze fees, investment checkups, and help your retirement plan. You can thank us later. Okay, what are your assets? Do you estimate how much every possession you own would be worth if you sold it? If you owe money on your house or car, are those assets or liabilities? Know you know what your net worth is, for better or for worse. But what should it be? The numbers are different for everyone because there are a lot of variables involved, but there are some general yardsticks that you can measure your numbers. Here are the median and average net worth by age. The median net worth of the average U.

Comments

Post a Comment