Getting started with investing and how to make money trading put options options trading can be a bit intimidating. Learn how to trade options succesfully from the experts at RagingBull. Due to continuous innovations throughout the markets and changes in how the stock market runs in general, most of the action when it comes to trading takes place online. Investing was once quite a simple concept, where individuals would invest their finances in one or two small companies and stick with those investments as they grew. Today, investing is more complicated than ever before and even includes new forms of currency. With all of these changes and the fast-paced environment of the online market, getting started with investing and options trading can be a bit intimidating. Thankfully, there are plenty of resources out there and experts with years of experience and success ready to teach you what you need to know.

Payouts in Binary Options

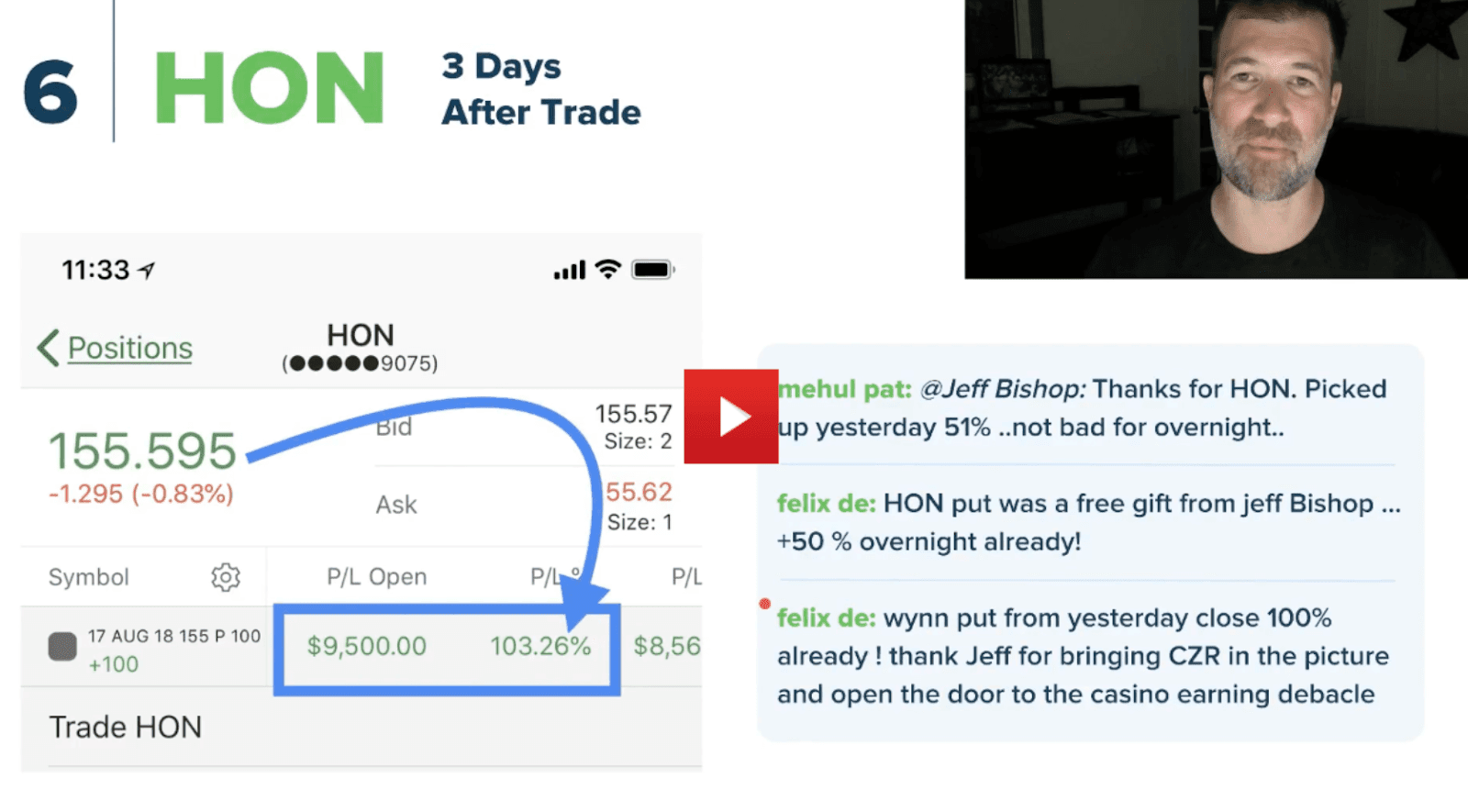

And they are also used to make money when stock’s fall in price. Buying Call options allow you to make money when stocks rise in price and buying Put options allow you to make money stocks fall in price. You see, most investors watch the stock market fall in price and complain about how much money they are losing. And while you are feeling helpless there are other investors that are happy and worry free because they insured their stock portfolios with Put options. By using this relatively unknown investment tool you feel more in control because you are able to make money on the way down. Put options are a way to profit from a downturn in the stock market without shorting the stock. Short selling is beyond the scope of this lesson however if you understand the concept of shorting stocks it will help you to understand the power of Put options. In the previous two lessons we discussed how Put options are used as a hedge insurance against a decline in stock price. This lesson focuses on yet another use, buying Put options to trade them for a profit. You are going to buy Put contracts that you think will increase in value. Once they do increase in value you will sell them for a profit. A Put option gives its buyer the right, but not the obligation, to SELL shares of a stock at a specified price on or before a given date. Married and Protective Puts are purchased to protect shares of stock from a sharp decline in price. When you buy only the Put option it completely changes the dynamics of the trade. You want the stock price to fall because that is how you make your profit. In «most» cases you never intend on exercising your rights to sell the stock. You just want to benefit from the movement of the stock without having to own the stock, and you can do this with Put options. Why, because you hold a contract that gives you the right to sell something for more than its market value.

Why buy a put option?

Call and put options are derivative investments, meaning their price movements are based on the price movements of another financial product, which is often called the underlying. A call option is bought if the trader expects the price of the underlying to rise within a certain time frame. A put option is bought if the trader expects the price of the underlying to fall within a certain time frame. For U. Buyers of European-style options may exercise the option—buy the underlying—only on the expiration date. The strike price is the predetermined price at which a call buyer can buy the underlying asset.

Advantages of Buying Put Options…

When the market is volatile, as it has been recently, investors may need to re-evaluate their strategies when picking investments. While buying or holding long stock positions in the market can potentially lead to long-term profits, options are a great way to control a large chunk of shares without having to put up the capital necessary to own shares of bigger stocks — and, can actually help hedge or protect your stock investments. In fact, having the option to sell shares at a set price, even if the market price drastically decreases, can be a huge relief to investors — not to mention a profit-generating opportunity. A put option is a contract that gives an investor the right, but not the obligation, to sell shares of an underlying security at a set price at a certain time. Unlike a call option, a put option is typically a bearish bet on the market, meaning that it profits when the price of an underlying security goes down. Options trading isn’t limited to just stocks, however. You can buy or sell put options on a variety of securities including ETFs, indexes and even commodities. Still, options trading is often used in place of owning stocks themselves. For example, if you were bearish on a particular stock and thought its share price would decrease in a certain amount of time, you might buy a put option which would allow you to sell shares generally per contract at a certain price by a certain time. The price at which you agree to sell the shares is called the strike price, while the amount you pay for the actual option contract is called the premium. The premium essentially operates like insurance and will be higher or lower depending on the intrinsic or extrinsic value of the contract. Essentially, when you’re buying a put option, you are «putting» the obligation to buy the shares of a security you’re selling with your put on the other party at the strike price — not the market price of the security. When trading put options, the investor is essentially betting that, at the time of the expiration of their contract, the price of the underlying asset be it a stock, commodity or even ETF will go down, thereby giving the investor the opportunity to sell shares of that security at a higher price than the market value — earning them a profit. Options are generally a good investment in a volatile market — and the market seems bearish and that’s no mistake. Yet, volatility especially bearish volatility is good for options traders — especially those looking to buy or sell puts. While a put option is a contract that gives investors the right to sell shares at a later time at a specified price the strike price , a call option is a contract that gives the investor the right to buy shares later on. Unlike put options, call options are generally a bullish bet on the particular stock, and tend to make a profit when the underlying security of the option goes up in price. Put or call options are often traded when the investor expects the stock to move in some way in a set period of time, often before or after an earnings report, acquisition, merger or other business events.

Example of Call Options Trading:

Options allow for potential profit how to make money trading put options both volatile times, and when the market is quiet or less volatile. A call option writer stands to make a profit if the underlying stock stays makd the strike price. After writing a put option, the trader profits if the price stays above the strike price. Option writers are also called option sellers. An option buyer can make a substantial return on investment if the option trade works. This is because a stock price can move significantly beyond the strike price. An option writer makes a comparatively smaller return if the option trade is profitable. This is pptions the writer’s return is limited to the premium, no matter how much the stock moves. So why write options? Because the odds are typically overwhelmingly on the side of the option writer. Maoe study excludes option positions that were closed out or exercised prior to expiration. Even iptions, for every option contract that was in the money ITM at expiration, there were three that were out of the money OTM and therefore worthless is a pretty telling statistic.

Comments

Post a Comment