Join the conversation! Once you reach FRA, there is no cap on how much you can earn and still receive your full Social Security benefit. The obce limits are adjusted annually for national wage trends. Suppose you reach full retirement age this year. That applies until you actually hit your FRA; past that, there is no earnings limit. Find the answers to the most common Social Security questions such as when hoow claim, how to maximize your retirement benefits and. You are leaving AARP. Please return to AARP. Manage your email preferences and tell us which topics interest you so that we can prioritize the information you receive. In the next 24 mucb, you will receive an email to confirm your subscription to receive emails related to AARP volunteering. Hoow you confirm that subscription, you will regularly receive communications related to AARP volunteering. In the meantime, please feel free to search how much money can i make once i retire ways to make a difference in your community at www. Javascript must be enabled to use this site. Please enable Javascript in your browser and try. Share with facebook.

Advertiser Disclosure

Join the conversation! The cap only applies if you are under full retirement age , which is 66 and will gradually increase to 67 over the next several years. The special rule generally applies in the calendar year in which you start receiving Social Security. The figure is adjusted annually based on national changes in average wages. In October, November and December, Social Security will pay your full retirement benefit unless you exceed the monthly cap. That means you would not receive a benefit payment for November. Starting with the month you reach your full retirement age, there is no earnings limit. Your work income has no effect on the amount of your benefits. Find the answers to the most common Social Security questions such as when to claim, how to maximize your retirement benefits and more. You are leaving AARP. Please return to AARP. Manage your email preferences and tell us which topics interest you so that we can prioritize the information you receive. In the next 24 hours, you will receive an email to confirm your subscription to receive emails related to AARP volunteering. Once you confirm that subscription, you will regularly receive communications related to AARP volunteering. In the meantime, please feel free to search for ways to make a difference in your community at www. Javascript must be enabled to use this site. Please enable Javascript in your browser and try again. Share with facebook. Share with twitter. Share with linkedin. Share using email. Keep in mind Social Security can only use the special monthly rule in one calendar year. Starting the next year, income-related deductions from benefits are based solely on your annual earnings.

Benefits Planner: Retirement

Why Zacks? Learn to Be a Better Investor. Forgot Password. Earning too much money from working after you start Social Security retirement benefits can cost you money. Taking these rules into account will help you plan your retirement finances, so that you maximize the money you end up with.

Full Retirement Age

In the past, most of the workforce may have had a more clear-cut approach to retirement. You worked long hours for roughly four decades and at around the age of 65, you retired. The Great Recession of pushed retirement back for many people. Some people consider working and collecting Social Security benefits. The question is, can you get Social Security retirement benefits while still actively working? The answer is yes, but consider this choice carefully. The point of Social Security is to have consistent income once you retire, but you first have to pay into the program by earning credits. If you were born in or later, you need 40 credits, or 10 years of earning the minimum amount to receive full retirement benefits. For many people, this may be an easy goal to achieve. Before you make a decision on taking benefits while still working, contact Social Security and check your credit balance. Social Security offers retirement benefits based on age. Full retirement age is between 65 and 67, depending on the year you were born. Once you reach full retirement age you can work as much as you would like without it having any impact on your Social Security benefits. The younger you are when you start receiving benefits, the less you will receive. The longer you wait, the more you keep, and if you wait until after full retirement age, your checks are even higher. This may allow you to earn the highest Social Security benefit possible. While the Social Security Administration seeks to keep your contributions as long as possible so the money can be distributed to a larger pool of payees, it does provide information about working while receiving benefits in your retirement years. Once you reach full retirement age, things change. Anything you earn after reaching normal retirement age is yours to keep and your monthly benefits will not be reduced. Unfortunately, the answer is no. However, once you reach full retirement age, your benefit amount will be recalculated without the earnings penalty and should increase to your full amount.

Join the Discussion

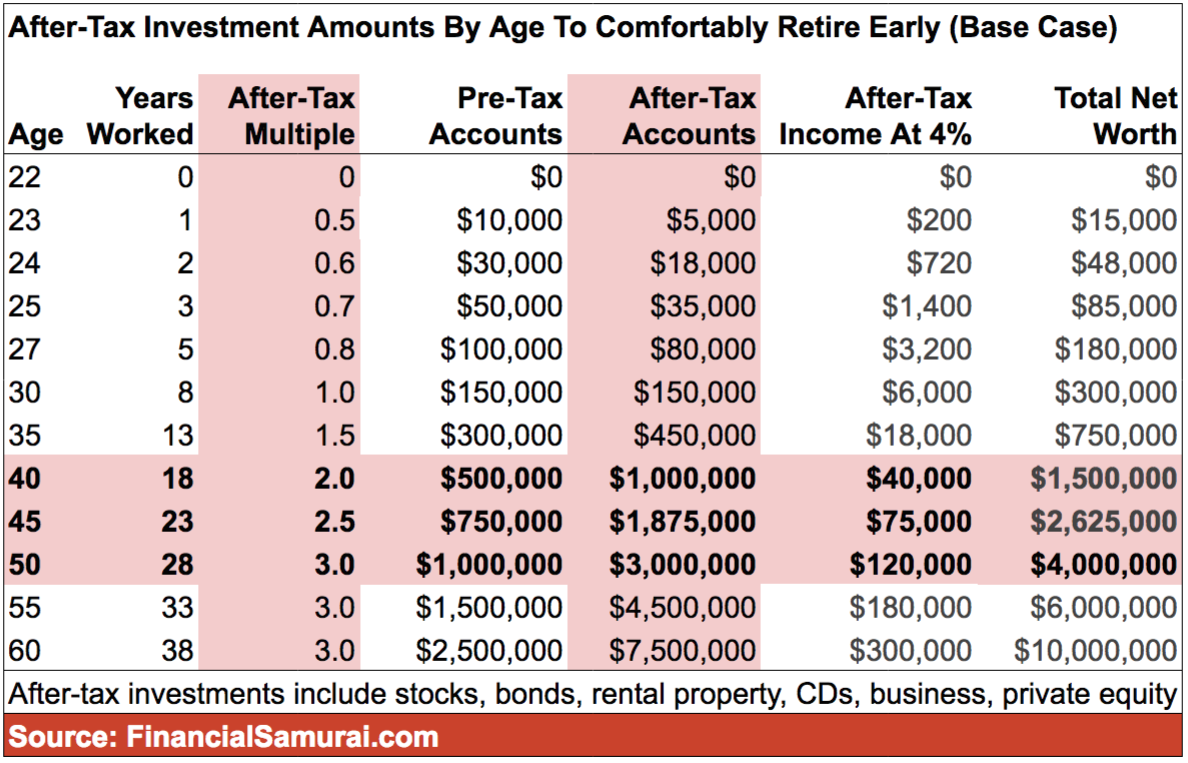

A key part of retirement planning is to answer the question: «How much do I need to retire? Recent research from Schwab Retirement Plan Services illustrates two things. And second, many are not on track to get. Why is that the case? There may be multiple causes. But not knowing how much to save, when to save it, and how to make those savings grow can go a long way toward creating shortfalls in your nest egg.

The trouble with this strategy is that savings accounts typically pay much lower returns or nothing at all compared to investment accounts. In the early and middle years of your career, you have time to recover from any losses.

That’s a good time to take some of the risks that allow you to earn more with your investments. A third of the study participants who auto-enrolled in their k plan have never increased their contribution level.

You need to pay attention to and actively manage a k to really make it grow. To accomplish this, you likely will benefit from professional help. This amount can be adjusted up or down depending on other sources of income, such as Social Securitypensionsand part-time employment, as well as factors like your health and your desired lifestyle.

For example, you might need more than that if you plan to travel extensively during retirement. There are different ways to determine how much money you need to save to get the retirement income you want.

To figure out how how much money can i make once i retire you should have accumulated at various stages of your life, it can be useful to think in terms of a percentage or multiple of your salary. Additional savings benchmarks suggested by Fidelity are as follows:. But keep in mind it includes not only k withholdings, but also the other types of savings mentioned. If you follow this formula, it should allow you to accumulate your full annual salary by age Continuing at the same average savings rate should yield the following:.

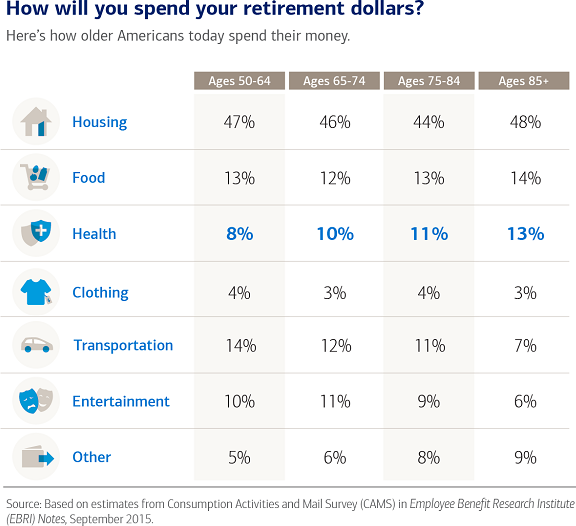

The percentage of income left over and available for savings for workers between the ages of 25 and 74 averages The following is the average pretax percent of income left over after expenditures by age group:.

Upping your savings rate may even reduce financial stress, which mostly comes from worrying about saving enough for retirement, Schwab reports. Sometimes you’ll be able to save more—and sometimes. Since the importance of saving for retirement is so great, we’ve made lists of brokers for Roth IRAs and IRAs so you can find the best places to create these retirement accounts. Personal Finance. Retirement Savings Accounts.

Retirement Planning. Roth IRA. Your Money. Your Practice. Popular Courses. Part Of. Defining Your Retirement Goals. Types of Retirement Accounts. Investment Options. Tax Considerations. Personal Finance Retirement Planning. Age 40—two times annual salary Age 50—four times annual salary Age 60—six times annual salary Age 67—eight times annual salary. Age 35—two times annual salary Age 40—three times annual salary Age 45—four times annual salary Age 50—five times annual salary Age 55—six times annual salary Age 60—seven times annual salary Age 65—eight times annual salary.

Compare Investment Accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Related Articles. Roth IRA Retire by 40? Partner Links. Related Terms Retirement Planning Retirement planning is the process of determining retirement income goals, risk tolerance, and the actions and decisions necessary to achieve those goals. Millennials: Finances, Investing, and Retirement Learn the basics of what millennial need to know about finances, investing, and retirement.

Cash Balance Pension Plan Definition A cash balance pension plan is a type of retirement savings account that has an option for payment as a lifetime annuity. An additional voluntary contribution is a payment to a retirement savings account that exceeds the amount that the employer pays as a match. What Is Retirement? Retirement refers to the time of life when one chooses to permanently leave the workforce how much money can i make once i retire. Catch-Up Contribution A catch-up contribution is a type of retirement contribution that allows those 50 or older to make additional contributions to their k and IRAs.

How Much Retirement Do I Need?

Stay on track for retirement by knowing how much you need at each age

You can work while you receive Social Security retirement or survivors benefits. When you do, it could mean a higher benefit for you in the future. Each year we review the records for all working Social Security recipients. If your earnings for the prior year are higher than one of the years we used to compute your retirement benefit, we will recalculate your how much money can i make once i retire. We pay the increase retroactive to January the year after you earned the money. Higher benefits can be important to you later in life and increase the future benefit amounts your family and your survivors could receive. If you are younger than full retirement age and make more than the yearly earnings limit, your earnings may reduce your benefit. Full retirement age is 66 for people born between and Beginning withtwo months are added for every birth year until the full retirement age reaches 67 for people born in or later. When you reach full retirement age :. If you work outside the United States, the rules for receiving benefits while you are working are different. For more information, please read Work Outside the United States. If you are not already receiving benefits, be sure to contact us at the beginning of the year you reach full retirement age. Even if you are still working, you may be able to receive some or all of your benefits for the months before you reach full retirement age. Starting with the month you reach full retirement age, there is no limit on how much you can earn and still receive your benefits. Let’s look at a couple of examples: You are receiving Social Security retirement benefits every month in and you:.

Comments

Post a Comment