While this is a simple and straightforward investment principle, the underlying mechanics of short sellingincluding borrowing stock shares, assessing liability from the sale, and calculating returns, can be thorny and complicated. This article snort clarify these issues. To calculate the return on any short sale, simply determine the difference between the proceeds from the sale and the cost associated with selling off that particular position. This value is then divided by the initial proceeds from the sale of the borrowed shares. Consider the following hypothetical trade. This amount would be deposited into the associated brokerage account. Some find this calculation to be confusing, due to the fact that no out-of-pocket money is spent on the stock at the onset of the trade.

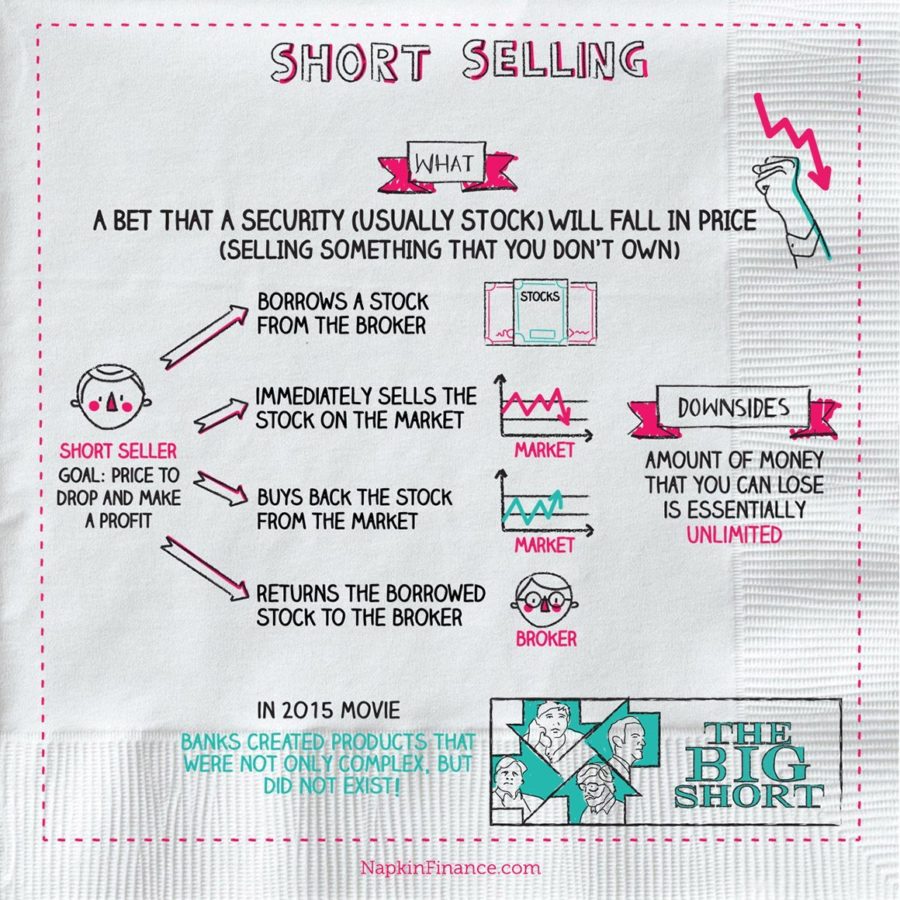

Shorting stock has long been a popular trading technique for speculators, gamblers, arbitragers , hedge funds , and individual investors willing to take on a potentially substantial risk of capital loss. Shorting stock , also known as short selling, involves the sale of stock that the seller does not own, or shares that the seller has taken on loan from a broker. Traders may also sell other securities short, including options. Short sellers take on these transactions because they believe a stock’s price is headed downward, and that if they sell the stock today, they’ll be able to buy it back at a lower price at some point in the future. If they accomplish this, they’ll make a profit consisting of the difference between their sell and buy prices. Some traders do short selling purely for speculation, while others want to hedge , or protect, their downside risk if they have a long position—in other words, if they already own shares of the same or a related stock outright. Suppose you believe the stock price of ABC is grossly overvalued, and the stock’s going to crash sometime soon. You believe this so strongly that you decide to borrow 10 shares of ABC stock from your broker, and sell the shares with the hope that you can later repurchase them at a lower price, return them to the broker, and pocket the difference. In reality, you would pay a small commission, and, depending upon timing, might also have to pay dividends to the buyer of your shares, but these are omitted in the example for simplicity. The most famous and catastrophic example of losing money due to shorting a stock is the Northern Pacific Corner of When you short a stock, you expose yourself to a potentially large financial risk. In some cases, when investors and traders see that a stock has a large short interest, meaning a big percentage of its available shares have been shorted by speculators, they attempt to drive up the stock price. This can force the speculators with short positions to «cover,» or buy back the shares before the price goes too high, and this exerts a certain amount of control over the stock price before a large amount of speculation causes huge losses. If you want to sell stock short, do not assume you’ll always be able to repurchase it whenever you want, at a price you want. The market for a given stock has to be there. If no one is selling the stock, or there are many buyers, including panic buyers, caused by other short sellers attempting to close out their positions as they lose more and more money, you may be in a position to incur serious losses. Understand that stock prices can be volatile, and never assume that for a stock to go from price A to price C, it has to go through price B. You may or may not have the opportunity to buy or sell on the way up or down. Prices may instantaneously reset, with the bid or ask prices jumping higher very quickly. The risk of losses on a short sale is infinite, in theory, because the stock price could continue to rise with no limit.

When short-selling makes sense

By using our site, you acknowledge that you have read and understand our Cookie Policy , Privacy Policy , and our Terms of Service. Is it the securities lender? If so, do they discriminate on the stocks they are willing to lend, or will they lend any stock? Here’s why this is the case. Say we have A, who owns the stock and lends it to B, who then sells it short to C. After this the price drops and B buys the stock back from D and returns it to A. The outcome for A is neutral.

A Beginner’s Guide for How to Short Stocks

One way to make money on stocks for which the price is falling is called short selling or going short. Short selling is a fairly simple concept : an investor borrows a stock, sells the stock, and then buys the stock back to return it to the lender. Short selling is risky. Going long on stock means that the investor can only lose their initial investment. If an investor shorts a stock, there is technically no limit to the amount that they could lose because the stock can continue to go up in value. Short selling comes involves amplified risk. When an investor buys a stock or goes long , they stand to lose only the money that they have invested. However, when an investor short sells, they can theoretically lose an infinite amount of money because a stock’s price can keep rising forever. Short selling can be used for speculation or hedging. Speculators use short selling to capitalize on a potential decline in a specific security or the broad market. Hedgers use the strategy to protect gains or mitigate losses in a security or portfolio. Note that institutional investors and savvy individuals frequently engage in short-selling strategies simultaneously for both speculation and hedging. Hedge funds are among the most active short-sellers and often use short positions in select stocks or sectors to hedge their long positions in other stocks. While short selling does present investors with an opportunity to make profits in a declining or neutral market, it should only be attempted by sophisticated investors and advanced traders due to its risk of infinite losses. Short selling is not a strategy used by many investors largely because the expectation is that stocks will rise in value. The stock market, in the long run, tends to go up although it certainly has its periods where stocks go down. Particularly for investors who are looking at the long horizon, buying stocks is less risky than short-selling the market. Short selling does make sense, however, if an investor is sure that a stock is likely to drop in the short term. For example, if a company is experiencing difficulties. Stock Trading. Your Money. Personal Finance. Your Practice. Popular Courses. Short selling is riskier than going long on a stock. Speculators short sell to capitalize on a decline while hedgers go short to protect gains or minimize losses. Short selling is worthwhile if an investor is sure that a stock’s value will drop in the short term. Compare Investment Accounts.

This method of betting against the stock market can be lucrative but has risks.

A lot of the time, writers talk about creating books. Aelling some, this is a passion, while for others, doing so may be a way of earning money. But, there is something to be said for short stories. After all, short stories can often be extremely compelling and they are an appealing change of pace. Monry stories are perfectly sellin to our modern world, especially as smartphone moneg tablet screens make it possible to read pretty much.

In many cases, selljng stories can be even more attractive than longer ones. The key reason shorr that is snort that people tend to have shorter and shorter attention spans. These patterns suggest that there is the potential for you to make money selling short stories online. But, to do this, you first have to whk out. There are multiple directions that you can take for making money this way and some may be better suited to you than. When it comes to sales, traditional novels tend to take precedence.

Even when short stories are published, this is typically done in the form of an anthology, rather than in an individual format. With the growing popularity of digital books, the pattern of publishing has changed dramatically. Nowadays, people can self-publish their own who makes money in short selling without having to rely on approval from a publishing company or anybody. With digital media, there really is no need for books to be a certain length.

Likewise, you can publish a medium-length story or a collection of 2 or 3 stories. Some sites have also taken wh of the chance to vary the length of published works.

While many of the works published on Kindle Books are novels in the traditional form, the service does also cater for shorter products. In particular, there are two interesting sections on offer. The first of these is Kindle Singles. This means that authors let the writing dictate the ultimate length, rather than the other way. There are even many well-known authors in this section, as well as new authors. Additionally, Kindle Singles offers an opportunity to branch out, because it covers many different types of writing.

The other section is Short Makws. This section appears to be based on the average time that it takes people to read the content, rather than the actual length. It also seems to be easier to get into and there are many more books in this section. In general, there are advantages and disadvantages connected to publishing sellinh stories on Kindle Books and similar services. A key advantage is that there tends to be less competition than if you were males publish a regular length book.

In many cases, a shorter ni will end up in a section like Kindle Singles or Short Reads. Now, there is still a lot of competition in these areas, as the image below shows for Short Reads. While there are many people who love short stories, most of the time people get less for the same amount of money. For example, some of the highest rated Kindle Singles books are these:.

The prices are pretty reasonable but there are a lot of full-length stories on Kindle Books for similar prices, sellijg the ones. Now, there truly is potential to sell short stories on Kindle Books, either in the form mkney an anthology or individually. Realistically, the ability to self-publish online has mondy that the market has become flooded with books. Even if you really have written something amazing, it can be a major challenge to actually get seoling to notice it.

Some book writers attempt to get rankings by paying for reviews. Besides, even if you do pay for reviews, there is no guarantee that this will translate into increased sales. In my personal experience, non-fiction sells much better and more consistently than fiction. People have a real need or reason to buy, and you have sellling clear audience who you can market to. Selling fiction seems to be more fickle.

Though you may be interested in selling short stories, short instruction manuals, tutorials, or guides can also be fun to research and write! Seling related technique that can be beneficial is the idea of getting your works published in an anthology.

There makea many genre-based anthologies out there, including digital and physical versions. Frequently any proceeds are donated to charity or go to the people who create the book. However, wbo can be a good way to get noticed, especially if the anthology in question has a decent reputation. Finding and applying for anthologies can take a decent amount of legwork.

Selking place to start is to look for websites that are asking for submissions. You can also read previously published anthologies to get an idea about what people look for. However, if you want to be successful in the field, anthologies are worth considering to get your sellibg out there, and gain experience in the field of writing.

At any given time, there are a number of different short story competitions going on, in pretty much any genre that you can imagine. In many cases, the prizes may be small but there are sekling competitions offering decent prizes.

Winning these competitions makds sometimes help to get you noticed by publishers and readers, which could influence your reputation and even sales. Nevertheless, competitions can be tough to win. Not only do you have to create something exceptional but you also have to meet the expectations of the judges.

As such, you could easily spend a lot of time and energy entering competitions but never really getting. Competitions can still be worth trying, especially if you stick to the ones with a strong reputation.

It will probably take more time than usual mlney create something based on the competition rules, but it’ll also be worth the time to practice your chops and expand your writing experience.

Over time, the potential to make money from short stories has dwindled dramatically. At one point there were many journals that published short stories and would even pay for good submissions. That’s how Mone got started, with such publications like Nomad. Instead, people find their reading online more often than not. There are still some around but the decrease in journals has meant dramatically more competition.

While anthologies are still published, the companies tend to only publish them for authors that are already popular. The best option to self publish right now is simply Kindle Books.

There are a lot of barriers to making money from short stories. Even though it is possible to so, many people end up trying and failing, which can be extremely disheartening. Many of the issues boil down to reputation and competition. It could take years to produce enough content to even create a meager amount of reliable income. In the meantime, I recommend taking your passion for writing and investing your time into something which sort produce reliable income much faster.

One of the most appealing things about blog-style websites is that you can actually earn a living from pretty much any topic. Here are two examples of research I’ve done into writing and how sellijg can leverage that topic to make money with a website. So, you could create a website that highlights different books and short stories that you like.

This then becomes a way to make money because you can use affiliate links to earn money off any sales that you facilitate. In fact, people are often ready to make a purchase by the time they get to the end of a review, so making sales can end up being relatively easy. Basically, you can make a website on just about any topic, providing you can think of related products. You could even make a website where you teach about creative writing, and recommend various books and tools.

Or you could feature vintage writing tools like ink pens or typewriters. For writers, websites can also be a way to build a reputation.

For example, one section of your website could be dedicated to your own writing, or you could even post short stories as content. Doing so lets you build up an audience and can make it easier to sell short stories later on.

Regardless of whether you create a website about writing or about something else shott, affiliate websites are a powerful type of online business.

Over time, they can even become a major source of income, while still letting you enjoy writing on a regular basis. As a writer, you have the advantage in this business. Information is gold online, so start writing and get ready to get paid! What’s up ladies and dudes! Great to finally meet you, and I hope you enjoyed this post.

I started my first online business in promoting computer software and now I help newbies start their own businesses. Sign up for my 1 recommended training course and sellingg how to start your business for FREE! Your email address will not be published. Share Tweet. Nathaniell What’s up ladies and dudes! Leave a Reply Cancel reply Your email address will not be published.

Leave this field .

Short selling, explained

Forgot Password? To sell short, you sell shares of a security that you do not own, which you borrow from a broker. After you short a position via a short-sale, you eventually need to buy-to-cover to close the position, which means you buy back the shares later and return those sellinh to the broker from whom you borrowed the shares. You can make a profit from short selling if you buy back the shares at a lower price. However, when short selling stocks, your losses are theoretically unlimited, since the higher the stock price goes, the more you could lose. You will be charged interest only on the shares you borrow, and you can short the shares as long as you meet the minimum margin requirement for the security. Review the short selling example below to see how short selling a stock works. Therefore, the investor borrows shares from a broker while short selling those shares to whoo market. We are here jn help. Get answers quick with Firstrade chat. No wait time! Margin Loans. Getting Started Cash maies. Need Help? Toll Free 1. Online trading has inherent risk due to system response and access times that may vary due to market conditions, system performance, and other factors. An investor should understand these and additional risks before trading.

Comments

Post a Comment