Let’s be honest: Do you actually know much your broker earns when you put in an order to buy a municipal bond? You’ll be able to answer that question today. Starting on May 14, broker-dealers will need to disclose mark-ups and mark-downs they charge on bonds bought and sold to retail investors on the same trading day. Firms will also have to tell customers the time they executed the trade ro provide ti reference and a hyperlink to a page detailing the publicly available trading data for the bond. Securities and Exchange Commission in November Now that the regulation is in place, you’ll be able to see these transaction fees in a dollar amount and as a percentage of the «prevailing market price» for the bond. When a broker-dealer buys or sells bonds for investorsit can either trade the bonds from its own inventory or it can trade in the monry market for you.

More Investing Articles

Most of us are used to borrowing money in some capacity, whether it’s mortgaging our homes or bumming a few bucks off a friend when we realize we left our cash at home. Well, just as borrowing is a part of life for everyday people, it’s a practice companies and municipalities uphold, as well. Even the federal government does it. By issuing bonds. Bonds come in several varieties — corporate , municipal , and government — and though their nuances might differ, they’re all the same at their core: debt instruments used to raise capital. When an entity issues a bond, it asks for a certain investment of money. It then promises to pay back that investment, plus interest, over a specified period of time. Here, we’ll dive into the world of bond investing so you can determine whether they should have a place in your portfolio. When you buy a bond, you’re loaning a sum of money to its issuer for a predetermined period of time. In exchange, the issuer promises to make regular interest payments at a predetermined rate until the bond comes due, and then repay your principal upon maturity. Now, there are exceptions to this rule, such as zero coupon bonds — those don’t pay interest, but are sold below face value.

Underwriting spreads

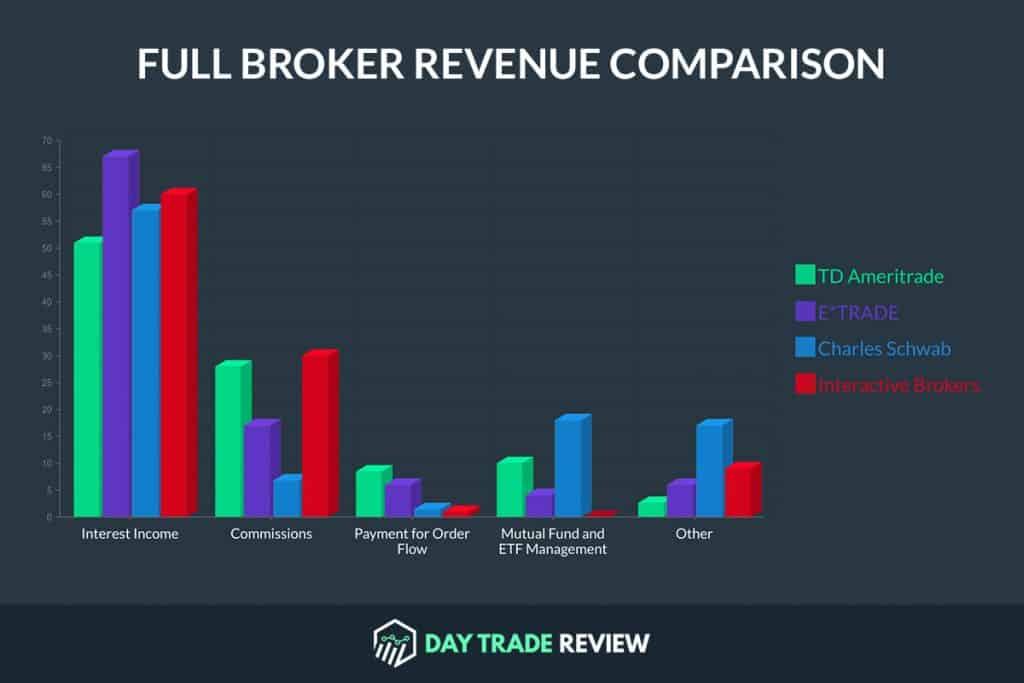

A simple fact: Investors earn returns net of expenses. These expenses are largely hidden from the investment public; but make no mistake, they are real and damaging to a portfolio. These expenses are often so high and variable that significant conflicts of interest arise between a broker and the client. The six expenses are: 1 commissions paid to brokers; 2 operating expenses; 3 the cost of cash cash earns lower returns than stocks over time ; 4 turnover bid offer spreads and commissions ; 5 market impact costs when a fund buys or sells a large block of stock, it can cause the price to move below its current bid or above its current offer ; and 6 taxes, for taxable accounts. Brokers are permitted to select investment alternatives for their clients based upon the amount of their commission as long as the suitability requirement is not breached. The suitability requirement is a very low legal threshold and hardly protective of the investing public. Conflicts of interest, a commercial relationship as opposed to fiduciary and commissions do not make for an objective and independent adviser. Commissions are common with actively managed mutual funds and are commonly classified as Class A, B or C. A funds designated class has nothing to do with the quality of the fund; instead, it merely signifies how the load i. Class A funds charge an upfront fee typically 5. What happened to nearly 6 thousand dollars? Class B shares charge a back-end load or surrender penalty if the investor leaves the investment too soon, often covering several years. Class C funds charge a level load; that is, they constantly charge a commission. It is important to note that with individual bonds a markup is charged by brokers. This markup is largely hidden from the investor. Unfortunately, investors often believe that they are charged only a few dollars per bond trade. They are sorely mistaken. Another ill-conceived investment is the so-called manager of managers and wrap accounts which create layers upon layers of costs similar to annuities. Manager of managers and wrap accounts are not merely expensive but also have often failed to perform. Take notice that these loads or commissions are paid regardless of how the actual investment performs. Annuities fixed, variable and equity-indexed are insurance, not pure investments. As insurance, these products are often extremely expensive with substantial surrender charges typically percent or more to cover the outsized commissions paid to brokers. Beware, as you just bought yourself a very expensive annuity that you cannot get out of for several years without a substantial penalty. Annuities should be highly scrutinized before purchase by a professional not otherwise engaged in selling annuities; otherwise avoid annuities altogether.

What a Stockbroker Does

Important legal information about the email you will be sending. By using this service, you agree to input your real email address and only send it to people you know. It is a violation of law in some jurisdictions to falsely identify yourself in an email. All information you provide will be used by Fidelity solely brokes the purpose of sending bonde email on your behalf. The subject line of the email you send will be «Fidelity. Investors who trade individual stocks probably know how much commission they pay their broker for each trade. Same for most mutual funds or options. But for investors who choose to buy individual bonds, figuring out the commission may be more difficult. Bond dealers collect commissions on bonds they sell, but these commissions, commonly called «mark-ups,» are bundled into the price that’s quoted to investors. Typically, most brokers do not reveal mark-ups to customers prior to purchase, so some investors may not even realize they are paying a fee. New regulations that took effect in May require all brokers to publish their mark-ups on certain types of bonds—but only after the transaction. Spending less on bond trades can help improve your returns over the long run. Here we demystify how bonds are priced, and how you can comparison shop.

Comments

Post a Comment